The most important number in the NDP’s first budget unveiled Tuesday is not how much money the government plans to spend on health care, education and family services. It’s the one that shows how much debt the government is taking on to pay for all of those things.

The province projects that its net summary debt will grow by a staggering $4.36 billion — a 14 per cent increase — this year. That’s significant. As a percentage of the economy, that debt is projected to rise in 2024-25 to 38.5 per cent, up from 34.6 per cent in 2023-24 — also very significant. A near-four percentage point increase in a single year is a huge jump and is sure to attract the attention of credit rating agencies.

So, why should people care? Because the higher the debt, the more money the government spends to service that debt and the less resources there are available for front-line services.

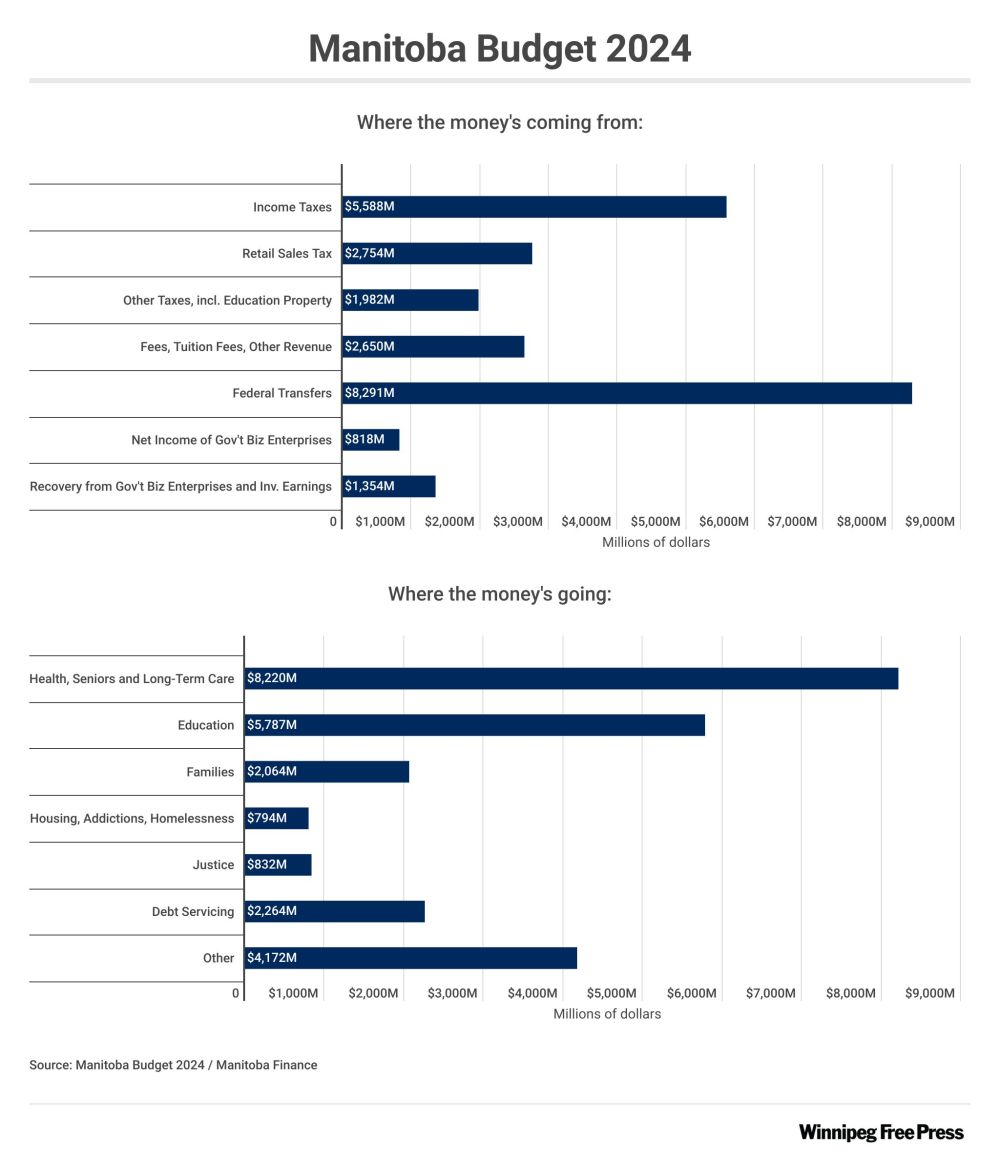

The province is projecting to spend $2.264 billion to service the debt in 2024-25. That’s up from $2.151 billion the year before — a $113 million increase in one year. It’s expected to rise to $2.547 billion by 2027-28. That’s a lot of money and is now well over 10 per cent of program spending.

A 38.5 per cent debt-to-GDP ratio is not necessarily cause for alarm. But a four percentage point jump in one year and a trend towards a higher debt load is not sustainable.

It could lead to a credit rating downgrade, which would drive up debt servicing costs even further.

The NDP government is planning to balance the books by 2027-28. That’s encouraging news, but it doesn’t mean the government will stop borrowing to pay for program costs and infrastructure spending. Under summary government reporting, the province’s core government operations can still be in deficit, even while reporting a surplus, if the shortfall is offset by net revenues from Crown corporations like Manitoba Hydro.

When that happens, the government still has to borrow to pay for program costs. In that case, the only way to measure the true health of the province’s books is to assess debt levels. Unfortunately, that part of the province’s balance sheet is not expected to improve over the next three years and could get worse.

While the province is projecting a small surplus of $18 million in 2027-28, provincial debt will continue to rise. The debt-to-GDP is projected to climb again next year to 39.1 per cent before it settles back down to 38.3 per cent in 2027-28 (higher than in 2023-24).

That’s a best case scenario that could change rapidly with one bad flood.

Credit rating agencies are concerned mostly with trends and fiscal sustainability. They will be encouraged to see that the government has a plan to balance the books by 2027-28. They will also keep an eye on debt accumulation and the sustainability of that debt. If debt-to-GDP hits 40 per cent and continues to trend higher, the province faces the risk of a credit rating downgrade.

That’s a real possibility, especially if the economy doesn’t rebound in a significant way this year or next. Economic growth drives taxation revenue. If GDP remains relatively flat this year and next, there won’t be much in the way of growth revenues to chip away at the deficit.

The only reason the NDP is planning to spend as much as it is in this budget is because of a massive increase (almost $1 billion) in additional transfer payments from Ottawa. There’s very little growth in the province’s own-source revenues this year.

The 2027-28 projected surplus is also based on very modest spending increases over the next three years. It seems unlikely the NDP will stick to those spending projections. The pressure from caucus and elsewhere to spend more will be great. Unless the economy expands faster than projected over that period, that surplus projection could easily get kicked down the road.

That’s what happened multiple times under former NDP premier Greg Selinger. Deficit targets were regularly missed and debt accumulation grew out of control. The result: three credit rating downgrades that drove up borrowing costs and left less money available for front-line services.

What Tuesday’s budget did not answer is how the NDP plans to make good on all of the spending pledges it made during last year’s provincial election, balance the books and bring down debt-to-GDP at the same time. So far, that appears to be more fantasy than reality.

tom.brodbeck@freepress.mb.ca

Tom Brodbeck

Columnist

Tom has been covering Manitoba politics since the early 1990s and joined the Winnipeg Free Press news team in 2019.